How to Manage Sustainability with Risk Assessments

How can sustainability teams interact effectively with risk managers to protect and enhance the organisation? What is ‘risk’ in a sustainability context, and how can it be managed?

How can sustainability teams interact effectively with risk managers to protect and enhance the organisation? What is ‘risk’ in a sustainability context, and how can it be managed?

There are burgeoning regulatory pressures, not least of all due to the impact of the EU’s 2019, launch of the European Green Deal (EGD). The EGD is a package of actions to reduce greenhouse gas emissions and to minimise the use of resources while achieving economic growth. This means that products sold in the EU market will need to meet higher sustainability standards. Even if you only export to the EU, your corporation is exposed to its impacts. Similarly, the US SEC is ramping up the pressure, while litigation against corporations (and targeting their directors and officers) on all fronts is aggressive.

Sustainability for any organisation, regardless of size, must include some, if not all, of declaring achievement of various of the UN Sustainable Development Goals (SDG), greenhouse gas (GHG) reduction (aka. your carbon footprint), and progress towards securing a favourable Environment, Social, and Governance (ESG) rating.

While PLCs must grasp the scale of the problem and have the budgets to do so, in the Small Enterprise / SME sector the processes are simpler while the budgets are lacking. Either way, as the scale of the organisation and its supply chain crosses nations or continents, the challenges – and the risks – grow exponentially.

That the pressures are increasing was summed up well by Mazars LLP, who commented:

“… although some companies have set up steering committees for general sustainability issues that have public reporting within their remit, from the companies interviewed, these sustainability issues do not appear to be filtering through to operational risk management”.

Unfortunately, risk managers are very rarely well versed in sustainability. However, given that the UN Global Compact has been in existence for almost twenty years, the embedding of its four pillars now needs to be prioritised, and certainly it must be addressed within corporate risk registers.

Conversely, Chief Sustainability Officers are rarely sufficiently competent in matters of risk. Your Head of Risk and your Chief Sustainability Officer, together with other persons and committees responsible for sustainability, need the appropriate tools and support to report ESG related risks.

Highlighting only a few examples of how risk and sustainability overlap, consider:

Stakeholders now include the general public, customers, employees, suppliers, and often the government too. The growing prominence of ESG dramatically impacts how directors and officers of public companies define and carry out their responsibilities, and it begins with adopting a corporate governance framework which recognises stakeholder interests together with the evolving regulatory landscape.

Your ESG framework should be adapted to offer a mechanism through which the process of environmental, social, and governance risk assessment and management can be explained to stakeholders, while supporting internal multidisciplinary teams in their duty to conduct risk assessments.

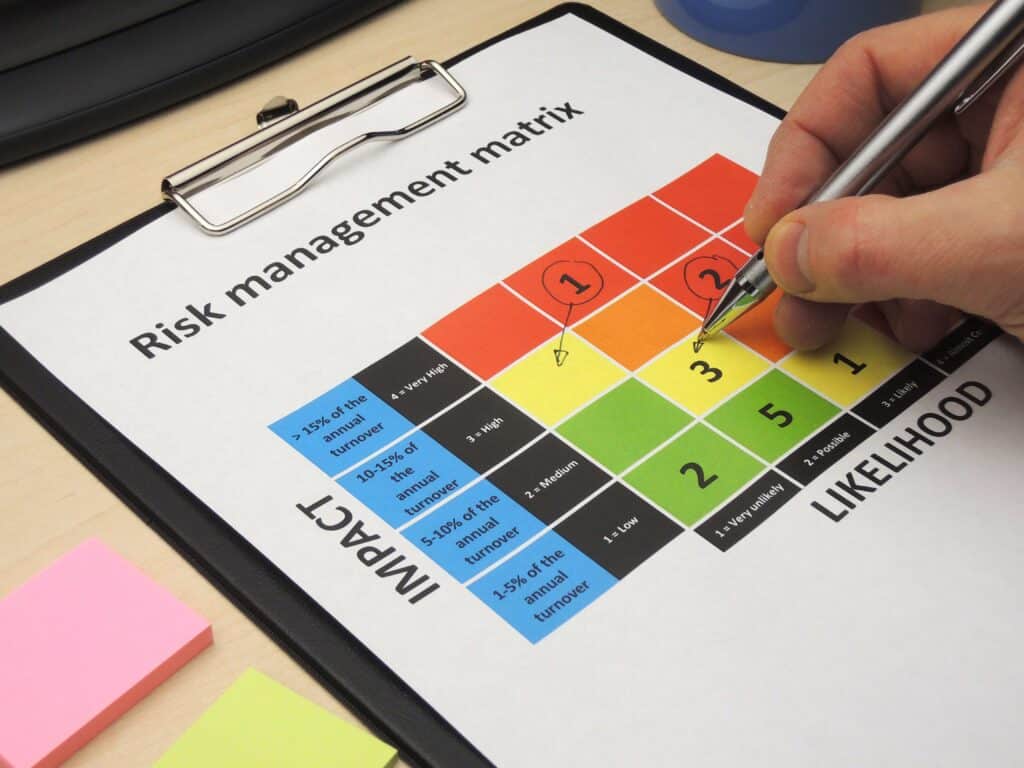

The process should prioritise the four main components of risk assessment:

As with all matters of risk, the approach should evaluate the findings in terms of positive and negative effects according to economic factors, environmental security, social issues and organisational capabilities. It then progresses to terminating, mitigating, transferring, exploiting or tolerating the risk. The implemented strategy should be monitored to ensure the risk is controlled to an acceptable level.

There is no universal method suitable for comparing and evaluating risk management options. Progress happens through the selection or adaptation of an existing methodology or development of a new methodology to reflect the needs of the organisation.

Once risks have been identified, these may be mapped to – or define – the organisation’s sustainability priorities. For some clients, especially governments, we find that developing a new framework to be used in parallel with existing accepted frameworks can prove most effective.

ESG factors are notoriously difficult to quantify in terms of risk unless the appropriate ESG frameworks (such as GRI, SASB, TCFD etc.) are rigorously applied. From these your sustainability team can develop a risk management approach.

Effective ESG reporting begins with honesty, transparency, and integrity. To add value, however, your ESG journey needs to be driven by action plan(s) targeted to delivering positive change. Continuous improvement is an imperative.

Within the three ESG criteria of Environment, Social, and Governance, there are numerous sub-criteria which range from the organisation’s carbon footprint, to employment, and executive compensation to suggest only a few.

For every sub-category, the nature of the resultant risks can be categorised within multiple headings, very often with many overlaps. For example, poor governance might be exemplified through a lack of progress towards the UN SDGs, but the consequential reputational risk in the event of an accidental emissions discharge might then be severe.

Your sustainability team need the tools to assess the state of your target market and their place within it by visualising and benchmarking their ESG ratings in a dashboard. This helps you to identify problems with how consumers perceive your brand’s ESG performance, as well as clarifying the main competitive advantages, which could have an impact on strategic business and investment decisions.

At ESG PRO, we specialise in supporting trans-national organisations which recognise the inherent risks of falling behind in terms of their overall sustainability reporting.

Governments and corporate clients alike recognise that the combination of regulatory demands, the UN SDGs, and reputational risk have formed an unwelcome triad of demands which have become problematic due to inattention.

Support for your internal sustainability teams and risk managers is tailored to their precise needs, enabling rapid progress, training, auditing, and support.

Humperdinck lectures on ESG, Risk, Supply Chain, and Net Zero and both Kingston University and UCL (University College, London). He leads the daily operations at ESG Pro and specialises in matters of corporate governance. Humperdinck hails from Bermuda, has twice sailed the Atlantic solo, and recently devoted a few years to fighting poachers in Kenya. Writing about business matters, he’s a published author, and his articles have been published in The Times, The Telegraph and various business journals internationally.