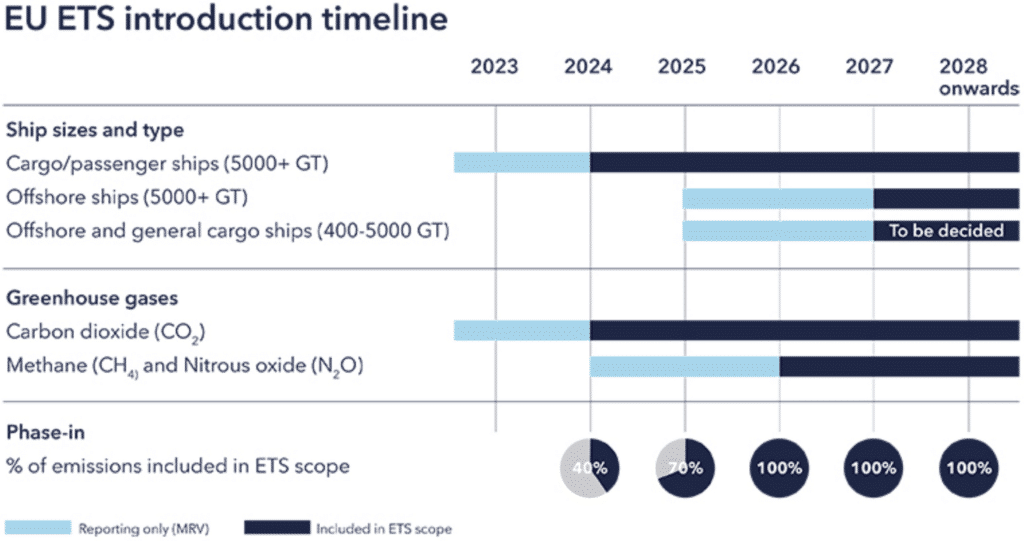

Under the EU MRV regulation, these businesses are required to monitor, report, and verify the GHG emissions on an annual basis, and this data is used to calculate the allowances they must give up. For shipping companies, the cost of buying allowances under the EU ETS can be a sizable expense, and this is likely to have an impact on the pricing and other terms of contractual agreements between parties across the value chain, including charterers and cargo owners.

To manage significant tax cashflows across the value chain, it will be necessary for all parties to have a shared and reliable basis of emissions performance data for voyage verification(12).

Overall, operations, costs, and contractual agreements in the maritime transport industry will be impacted by the EU ETS. Shipping companies must be diligent and take steps to cut emissions, including improving operational efficiency, making investments in low-carbon technologies, and switching to alternative fuels in order to stay competitive on the transport and logistics market.

Road transport – The introduction of ETS II will undoubtedly come as a big blow to the road transport and logistics industry. Paying a carbon tax won’t be the only fee the industry will have to pay, as the oil companies will have to pay for carbon allowances raising fuel prices by the margin of the allowances that have been paid to produce fossil fuels, affecting both road transport companies, as well as EU citizens.

For further information on the impacts of expanding the ETS to the road transport read more on the EU study – Possible extension of the EU Emissions Trading System (ETS) to cover emissions from the use of fossil fuels in particular in the road transport and the buildings sector.

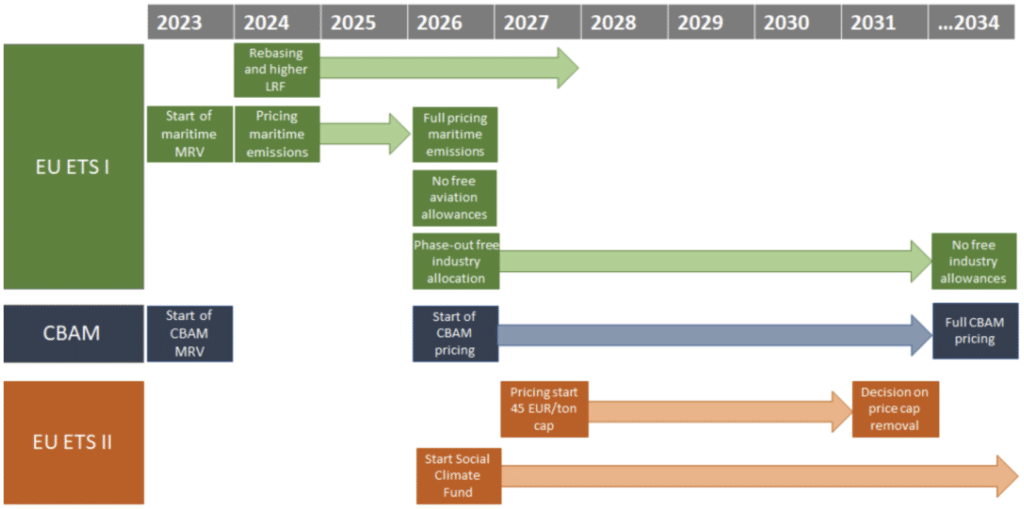

Aviation transport – In Europe, direct emissions from aviation accounted for almost 4% of total CO2 emissions in 2017(13). In an attempt to mitigate this the EU is covering the aviation industry within the framework of the ETS, as well in the CBAM. These frameworks shall be applied to each flight that depart from or arrive in an aerodrome situated in the territory of a Member State(14).

In order to make sure that the industry helps achieve EU and global climate goals, on 6 December 2022 the EU Parliament and Council reached a provisional agreement on revising the ETS for aviation to tighten the rules for lowering carbon dioxide emissions from air travel. The updated ETS will include the ICAO’s globally agreed-upon market-based Carbon Offsetting and Reduction Scheme for International Aviation as a result of the new regulation (CORSIA). In case of a negative evaluation of CORSIA’s progress by 1 July 2026, the European Commission would be required to make a proposal to include in the scope of the EU ETS emissions of flights departing from an airport located in the European Economic Area (EEA) to a third country. By 2027, flights to foreign countries that do not implement CORSIA will be subject to the ETS.

The deal foresees a gradual end to the free allocations of allowances in the aviation sector by 2026, one year ahead of the timetable proposed by the European Commission. However, the EU agreed to reserve 20 million allowances, between 1 January 2024 and 31 December 2030, for commercial aircraft operators who increase their use of sustainable aviation fuels (SAF), including advanced biofuels, fuels from non-biological sources of renewable energy, and hydrogen from renewable energy sources.

In an unprecedented measure, beginning in 2025, airlines will be required to report the release of potential “non-CO2 impacts.”

This includes dangerous gases released from jet engines, such as nitrogen oxides, sulphur dioxide, and soot particles.

In 2028, a legislative proposal will be made to include these emissions in the EU ETS’s purview.

Other actions foreseen by the law include:

- The Innovation Fund will use the proceeds from the auction of 5 million aviation allowances to support modern technologies, including electrification;

- There will be a derogation for emissions occurring up until 2030 from flights between airports in the most remote parts of one EU country and airports in that same country, as well as flights between airports in the most remote parts of the same EU country;

- In order to increase transparency, aggregated annual emissions-related data will start to be provided in 2023 in a user-friendly format(15-16).

However, before the agreement can go into effect, it must receive formal approval from the European Council and Parliament.

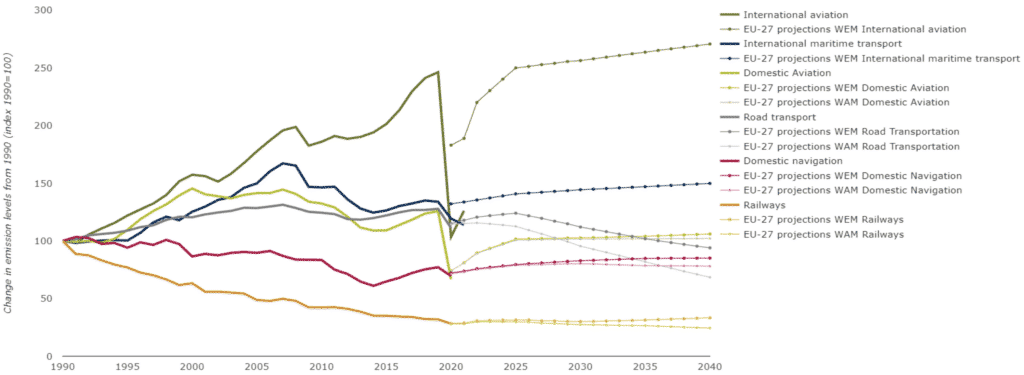

Railway transport – After the implementation of all the environmental laws and mechanisms that have been discussed thus far, we can say that the railway transport may come out as an absolute winner.

However, this is not a given. It very much depends on the will and cooperation between the EU and EFTA countries to make railways a viable mean of transport.

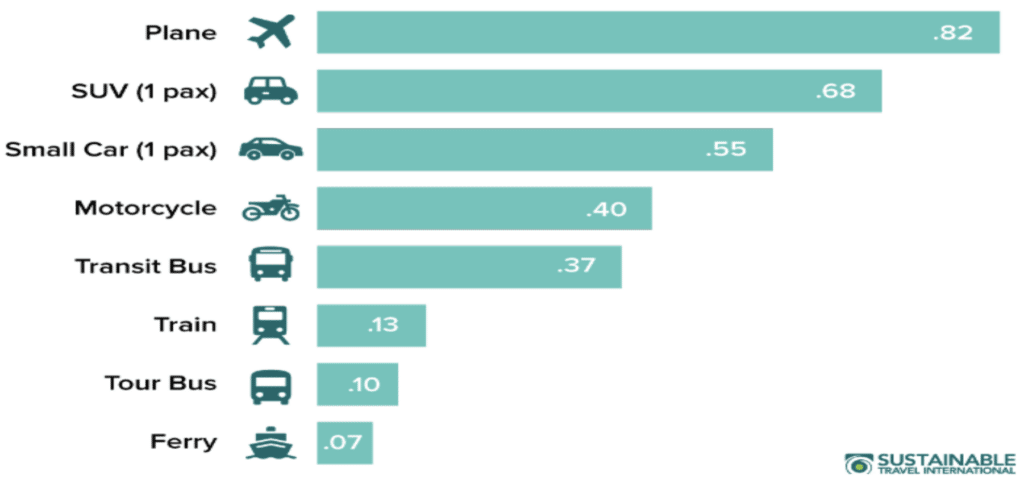

Since the 1990’s the railway has been the most environmentally friendly mean of transport when it comes to greenhouse gas emissions (see graph 1 and 2). So why isn’t the railway transport preferred for travel and transport of goods?