To fulfil their section 172 obligations, directors must understand their stakeholder community. A stakeholder is any individual, group, or organisation that may be affected by or have an impact on a company’s decision, activities, or outcome.

The stakeholders of your organisation can include many diverse groups or individuals. They may influence, use, or benefit, or otherwise be impacted by your undertakings, or those who have special knowledge of the current situation, and those that will use, support, or maintain the final product or service.

By clustering stakeholders according to common needs, your list reduces to a more manageable length, increasing the efficiency and impact of your efforts to meet the right groups’ needs.

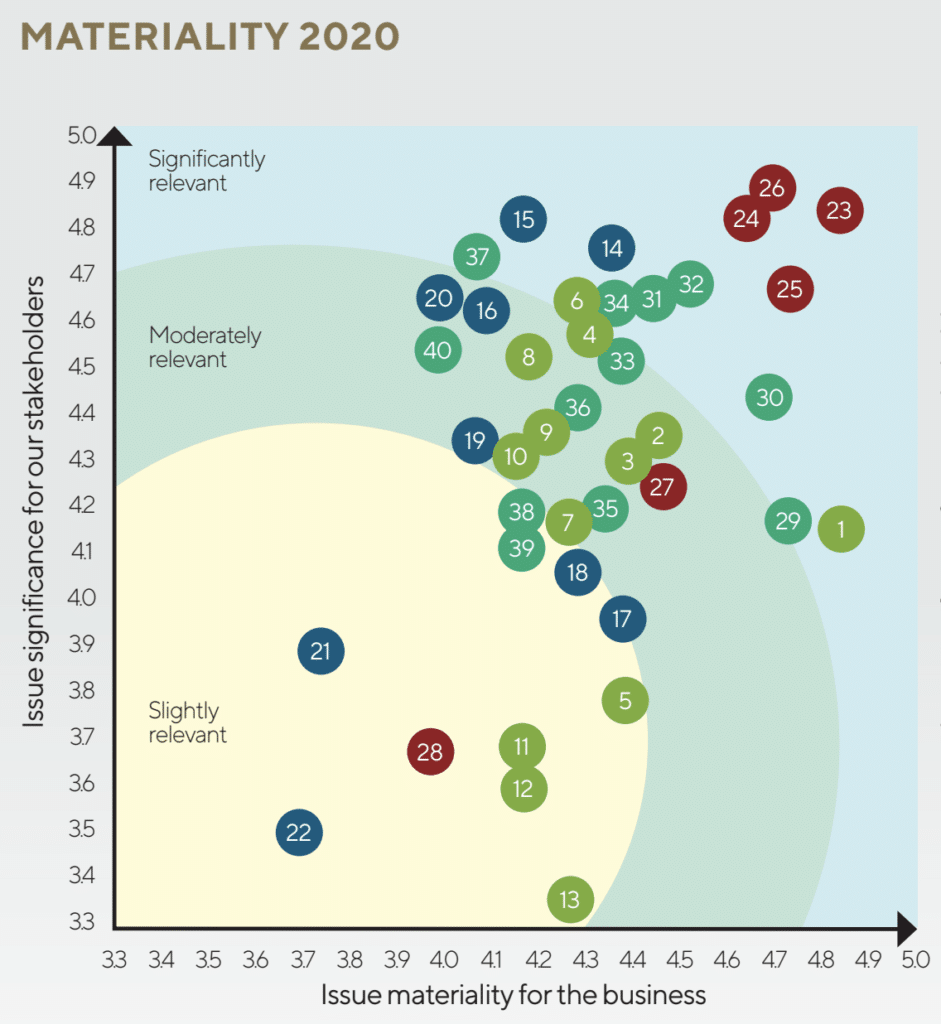

Your materiality assessment weighs the topics from a dual materiality standpoint, which recognises the difference between material topics of importance to your stakeholders vs. those of primary importance to the business. In the example materiality assessment published by Fresnillo, one can see the impact.

In this light, you can see that your stakeholders extend far beyond your management, employees, and investors, and extends through to those who:

- could be affected by your operations?

- could be affected by your marketing?

- could have an interest your success?

- might have a financial interest/stake?

- approves any sources of funding?

- sets the vision/goals?

- approves strategic changes?

- will use your end product?

- will service your end product?